Loan default rate falls with enrollment, financial aid challenges still ahead

Tyler McNeil

Creative Editor

Despite fewer students defaulting on student loans at Hudson Valley, many still take out heavy debt from local transfer schools and struggle with financial literacy coming into college.

The loan default rate dropped from 19.7 to 13.3 percent in the recent release of the 2012 cohort. According to Heather Teale, assistant director of financial aid, the loan default rate dropping is linked to decreased enrollment within the last three years.

“While I’m sure that some of the reduction in students borrowing is relative to the decline in enrollment, I would also attribute some of it to students being more informed and cognizant of the ramifications associated with taking on unnecessary loan debt,” said Teale.

“I’m always concerned with student debt. It has increased over the last couple of years,” said Drew Matonak, Hudson Valley president. Currently, student loan debt exceeds credit card debt nationwide.

“We put a lot of effort into educating students when they’re here, when they’re thinking about coming here and even when they’re in high school. We put a lot of time, energy and resources into educating the public about financial aid,” said Dennis Kennedy, director of communications and marketing.

In the summer of 2014, Hudson Valley started using Loanlook, a product based around managing student debt offered by the I3 group, which has about 584 active users in the student body.

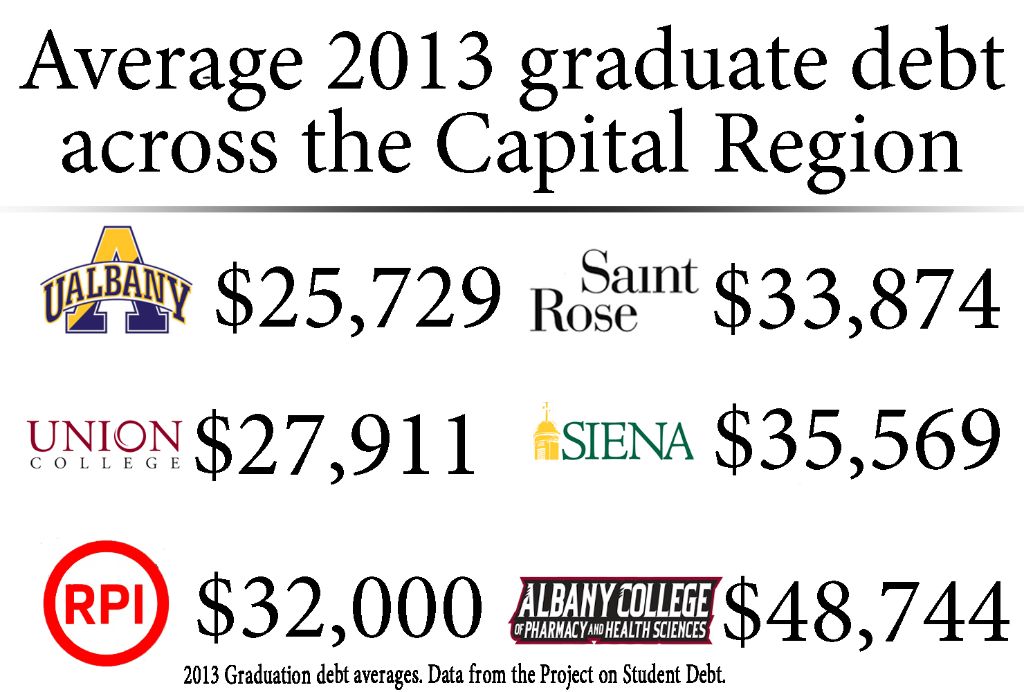

Debt for Hudson Valley students is low in contrast to four-year institutions in the Capital Region. RPI graduates are typically $32,000 in debt with 67 percent of recent alumni in debt in 2013. At UAlbany, 69 percent of graduates are in debt averaging $25,729. Union College is only a point higher in number of students with debt, with debt in between RPI and UAlbany at $27,911.

“It’s going to be challenging carrying on debt after Siena. I’m covered now but, this is really just the beginning of the storm,” said Stephanie Class, business administration major.

Monica Walsh attended Hudson Valley in the fall but is no longer eligible for financial aid and unable to attend this semester. “Sometimes I get sick thinking about all the money I’m going to have to borrow, but there’s no way around it. My dad lives paycheck to paycheck and my mom passed away,” said Walsh. “I was thrown into college with no idea. I didn’t really know anyone who went to college so I had to figure everything out on my own.”

Although loans still burden students after college, state aid programs such as the Tuition Assistance Program (TAP) increased for the first time in 14 years last year from a maximum of $5,000 to $5,165 per student. “We made some incremental progress over the last couple of years but not significant progress,” Matonak said.

“I don’t know of any other state that has a program like TAP,” Matonak said. The New York Community College Association of Presidents was victorious last year in lobbying for TAP increases. According to the college’s financial aid office, 3,592 students qualified in the for TAP at Hudson Valley in the 2013-14 academic year.

Although TAP has been raised, Matonak added that federal aid should open up. “Pell [Grants] handle high needs students very well. They’re good. The middle ground is the group that is struggling. That’s the group that tends to take out more debt,” said Matonak. About 4,262 students at Hudson Valley received a Pell Grant in the 2013-14 academic year.

In 2012, 53 percent of those without a Pell Grant nationwide had debt averaging $26,450 per borrower, $4,750 less than the average debt for Pell recipients with debt. Eighty-two percent of full-time community college students need financial aid but only two percent have their needs fully met with grants according to the Institute for College Access & Success.

“It’s not just an issue for community colleges; it’s an issue for all of higher education,” he said.