U.S. Tax Cuts and Jobs Act affects students

Rich Decker

Staff Writer

The U.S. Senate passed its version of the U.S. Tax Cuts and Jobs Act last week, which would lower the corporate tax rate from 35 percent to 20 percent.

The new act could potentially add up to a trillion dollars to the federal deficit over the next ten years, according to an analysis by Congress’s Joint Committee on Taxation, a nonpartisan scorekeeper for national tax law.

Analyzing the 470-plus pages of the bill, the passing of the finalized US Tax Cuts and Jobs Act, as written by a conference committee between the two chambers of Congress, could result in significant consequences for students, not just at Hudson Valley, but nationwide.

“At a time when our economy is demanding more education for more of our citizens, we cannot erect new barriers for the millions of Americans who need affordable higher education,” wrote Margaret Spellings, president of the University of North Carolina system and a former education secretary, under President George W. Bush.

Specifically, the bill repeals the student loan interest deduction, which allows for student loan borrowers of any age to lower their taxable income if they make less than $65,000 per year.

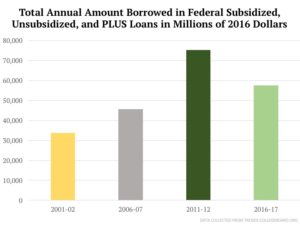

“Currently, over 44 million Americans hold a total of $1.4 trillion in student loan debt. It takes the average student debt borrower 20 years to pay off their loans, and over 3,000 people default on their federal student loans every day,” said Abigail Hess of CNBC.

This has significant impacts for both current students and younger children of lower-income families. The ban would prevent parents from depositing $2,000 per-beneficiary per-Coverdell Savings account per-year that can later be withdrawn tax-free if used for qualifying education expenses, such as private grade school and college tuitions. The tax bill expands the use of similar 529 plans.

Additionally, under the Senate bill, tax law would no longer allow people repaying their student loans to reduce their tax burden by up to $2,500 per year. Employers who cover portions of college tuition would also begin to see that money become taxable.

The possible passing of a final bill has sparked discussion of the bill’s potential outcomes, both negative and positive.

“One thing I did like [about the bill] was the lower interest rate when you’re taking your money back, as that’s more money that can go into the country’s circulation instead of overseas,” said Jake Loiselle, sophomore business administration major. “However, the rest of the bill, honestly, what the hell? It could stop people who are on the margin from going to college, and we definitely should not let that happen.”

Alongside the many ramifications for students alone, the House bill repeals the interest deduction on various types of bonds. The most notable of these repeals is that of the private activity bonds which municipalities often utilize to finance hospitals, housing and other projects.

“Right now, bond interests are being kept artificially low so that allows them to float to where they should be,” said Kyle MacMillan, sophomore business administration major. “So, essentially, you can make more money [to fund these projects], but it’s a double-edged sword.”

With the proposed legislation advancing to its final stages, local governments are worried this aspect of the bill will impede their ability to finance major infrastructure project, specifically affordable housing for families.

The nearly five-hundred-page document includes several questionable clauses. Among the most intriguing are the possibility of college savings for the unborn in the House version of the bill, tax cuts for beer, wine and distillers and a provision allowing for private jet-owners to avoid a special excise tax. The bill prevents taxes from being imposed on aircraft owners for money spent on “services related to maintenance and support of the aircraft owner’s aircraft or flights on the aircraft owner’s aircraft.”

“Private jet owners are getting more tax exemptions than I do as a student,” Loiselle said. “I think the best way to go about this is not pass [the final bill] and then figure it out from there.”